Schedule For 2024 Capital Gains? – Capital gains are reported on Schedule D, which is submitted with your federal tax return (Form 1040) by April 15, 2024, or October 2024, with an extension. The table below provides an overview of . The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Most people use the Schedule D form to report .

Schedule For 2024 Capital Gains?

Source : www.forbes.com

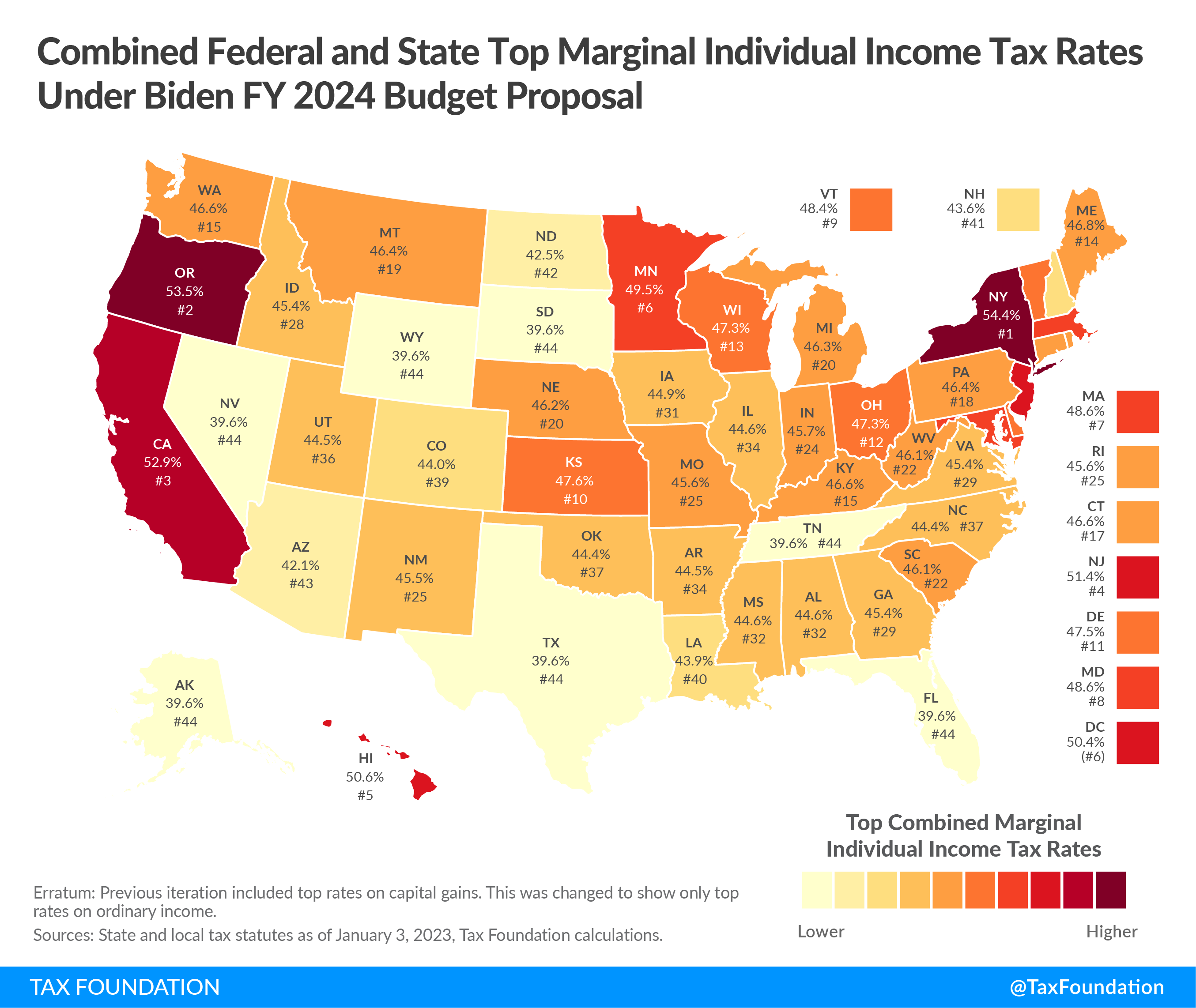

Biden Capital Gains Tax Plan | Capital Gain Rates Under Biden Tax Plan

Source : taxfoundation.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

Biden Budget Taxes Top $4.5 Trillion | Tax Foundation

Source : taxfoundation.org

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

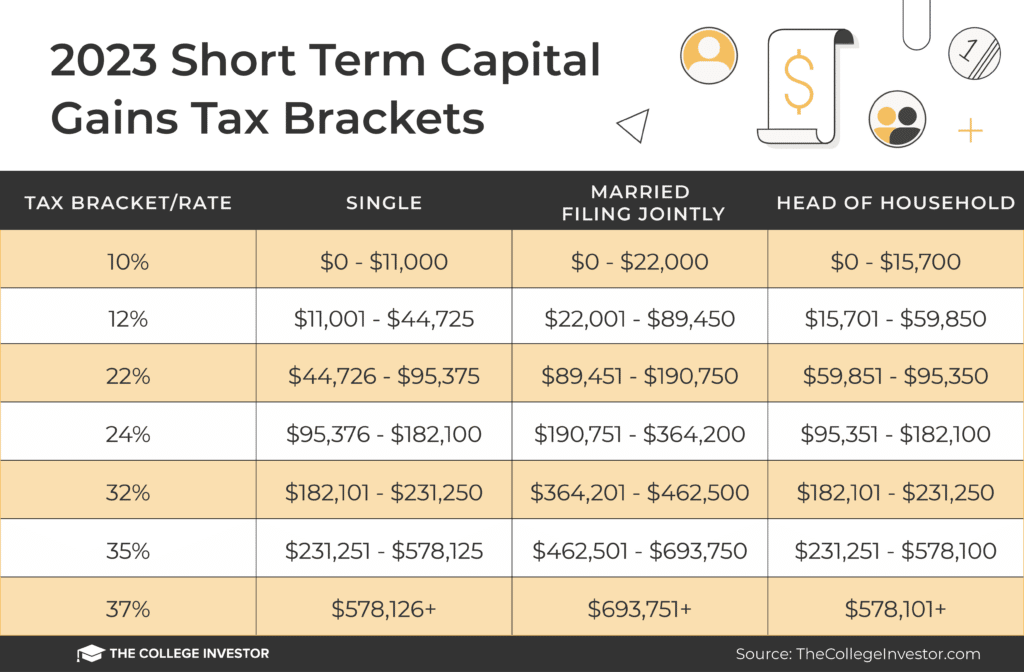

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

How much you can make in 2024 and still pay 0% capital gains taxes

Source : www.cnbc.com

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

2023 2024 Tax Brackets, Standard Deduction, Capital Gains, etc.

Source : thefinancebuff.com

Capital Gains Tax Brackets For 2023 And 2024

Source : thecollegeinvestor.com

Schedule For 2024 Capital Gains? Your First Look At 2024 Tax Rates: Projected Brackets, Standard : 30,00,000. Cost Inflation Index, CII= Index for financial year 2024-25/Index for financial year 2015-2016 = 1024/480 = 2.13 Indexed cost of purchase = CII x Purchase Price = 2.13 x 10,00,000 = . Less than 36 months for regular assets and 12 months for shares More than 36 months for regular assets and 12 months for shares Short term capital gains = sale cost .